Intensification of differentiation! Ecuadorian white shrimp exports: giants shrink, rookie rises

Recently, Ecuador Customs released the July white shrimp export data reveals the profound changes and differentiation trends within the industry. While overall export volumes remained stable, performance varied widely among suppliers, with a sharp decline in exports from the largest suppliers in sharp contrast to a surge in exports from small processors.

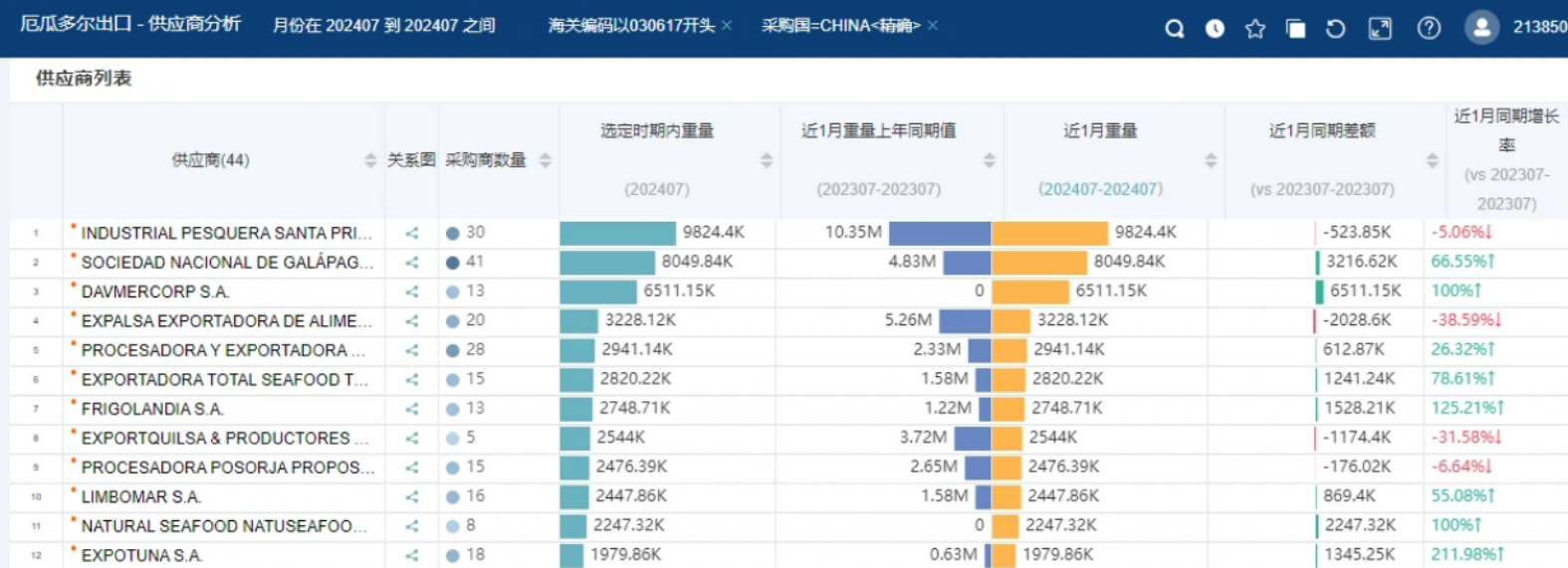

The biggest supplier encounters Waterloo

The sharp decline in exports from SANTA, Ecuador's leader in white shrimp exports, is particularly striking. In July, its export volume decreased by 5.06% year-on-year to 9824.4 tons, showing that even industry giants are unable to stand alone and face multiple challenges such as fluctuations in international market demand, increased competition and uncertainty in global trade policies. SANTA's woes may be seen as a microcosm of the pressures facing the industry as a whole, especially when the traditional market demand structure changes, and large suppliers tend to be more vulnerable due to their large size and relatively low flexibility to adjust.

Traditional old factory collective pressure

Similar to SANTA, other traditional old factories such as EXPALSA and EXPORTOUILSA were not spared, with exports falling by more than 25% year on year. These factories have long dominated the market, but in the face of rapidly changing market environments, their inherent market strategies and operating models may have difficulty adapting to new competitive situations. This may be the lag effect of market strategy adjustment, or the result of insufficient grasp of new trends in the international market. In any case, the setback of the old factory not only reflects the increased competition within the industry, but also reveals the vulnerability of traditional advantages in the context of globalization.

Small processing plants have sprung up

In sharp contrast to large traditional factories, some small processing plants seized market opportunities in adversity and achieved rapid growth in export volume. These plants such as DAVMERCORP SA., FRIGOLANDIAS S.A.、 And EXPOUNA S.A., export volume increased by more than 100% year-on-year, becoming a clear stream in the industry. The reason why small processing plants can rise rapidly, on the one hand, thanks to their flexible operating mechanism and keen market insight, they can quickly adjust their production strategies to meet market demand; on the other hand, they may focus more on specific markets or segments, and win customers 'favor by optimizing product structure, improving product quality and service level.

Deep logic behind industry differentiation

The differentiation phenomenon of Ecuadorian white shrimp export market is not accidental, but the result of many factors. On the one hand, changes in international market demand and uncertainty in global trade policies have put traditional suppliers under great pressure; on the other hand, small processing plants have rapidly emerged with flexible market mechanisms and efficient operational capabilities. Finally, the intensification of competition within the industry is also one of the important factors driving differentiation, especially in the case of saturation of traditional markets, the development of emerging markets and market segments has become the focus of supplier competition.

-

Ecuadorian Shrimp-It's Not Easy To Love You

2024-07-04 -

The AI Lecture of Zhanjiang Chamber of Commerce was successfully held in Quanlian Centralized Procurement, helping the enterprise to upgrade its digital intelligence

2025-04-18 -

Tilapia Tariff Raised to 45%, U.S. Market Waiting for Change

2025-04-02 -

Into the Northwest Frozen Food Hub| All-Union Centralized Procurement Visits Lanzhou Jiaojiawan Frozen Market

2025-03-07 -

China's Ministry of Commerce's latest response to the US imposition of a 10% tariff on Chinese exports to the United States

2025-03-04 -

Ecuador shrimp industry new era, 2024 top ten shrimp enterprises list announced

2025-02-26