Tilapia Tariff Raised to 45%, U.S. Market Waiting for Change

After the Boston show, the U.S. farmed whitefish market is still unclear

After the just-concluded Boston International Aquatic Show, the future of white fish (including tilapia, basa fish, catfish, etc.) in the US market is still full of uncertainty. Among them, tilapia tariff problem is particularly prominent. With the US composite tariff on China origin tilapia rising to 45%, importers face higher procurement costs, weak market demand and a cautious adjustment period in the supply chain.

Tariffs soar, but market prices do not fluctuate significantly?

Normally, tariff increases would directly push commodity prices higher, but as of March, wholesale prices of frozen tilapia in the United States had not changed significantly. The phenomenon has sparked debate in the industry: why is there a disconnect between rising costs and market pricing?

According to industry analysts, this may be affected by multiple factors, including: Inventories in the U.S. market are still at relatively moderate levels and can absorb cost pressures in the short term; With the reciprocal tariff policy to be implemented in April, market sentiment is more cautious. Supply chain buyers are mostly in a wait-and-see state, minimizing unnecessary purchases to avoid high cost risks.

Importers seek alternatives, Central and South America supply grows

Faced with rising import costs, U.S. buyers are realigning supply chain strategies, and chilled tilapia from Central and South America are gradually entering the market. Although tilapia from these areas cannot completely replace China supply, they can relieve import pressure to some extent. Currently, the price of chilled tilapia in the United States has started to rise slightly in the 13th week.

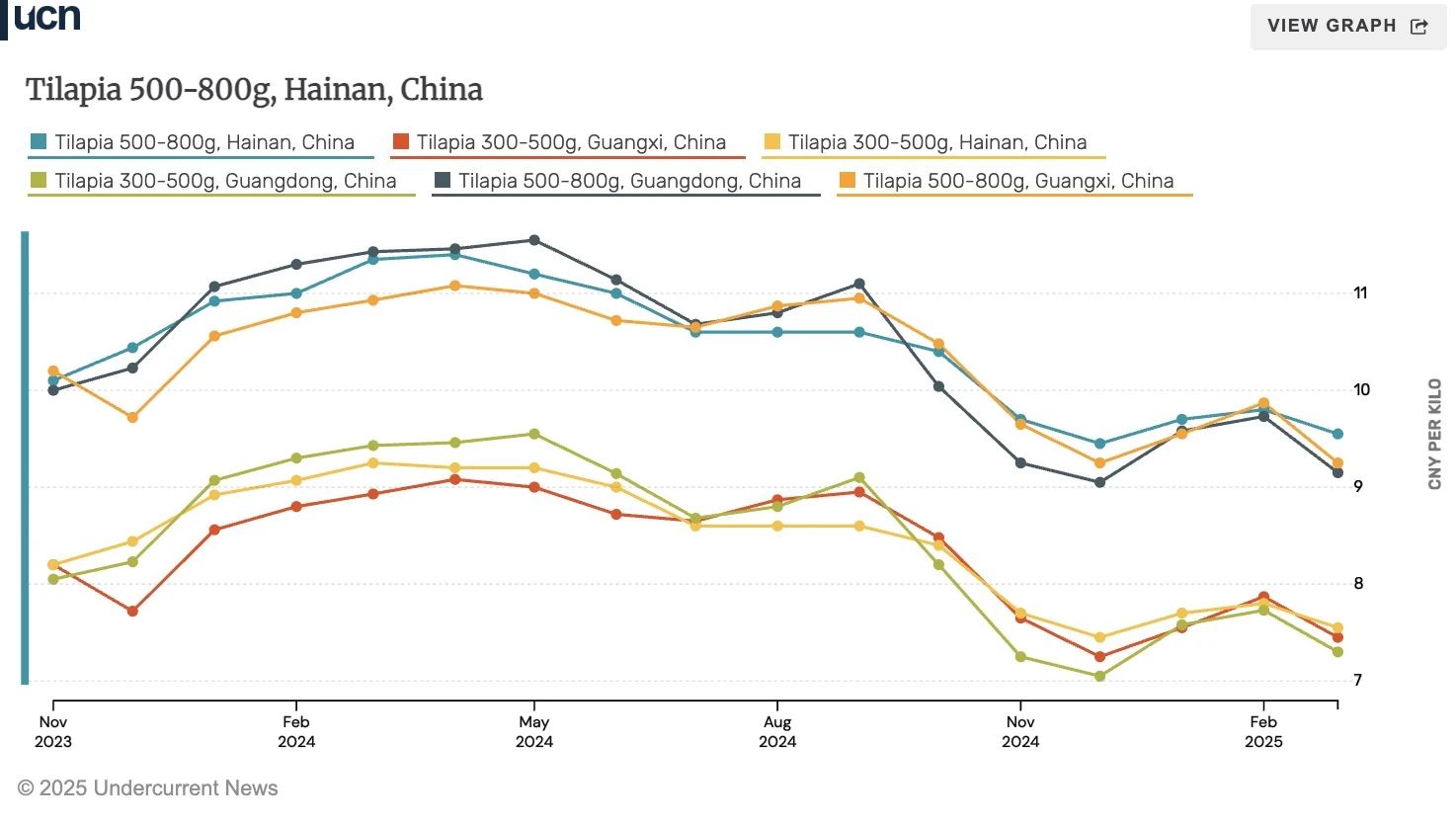

At the same time, China tilapia farming industry is also facing new challenges. Affected by environmental policies, farms must install tailwater treatment facilities if they want to obtain export qualifications, which increases infrastructure investment costs. In addition, in March, the purchase price of tilapia in Hainan was stable at CNY 9.8/kg (500 - 800 g), and the price in Guangdong was about CNY 9.2/kg, which did not decrease significantly. Faced with high tariff pressures, China exporters are reducing shipments to the U.S. market and instead exploring emerging markets such as Europe and Africa.

Basha fish supply is tight, prices may rise in the coming months

Compared to tilapia, Vietnam basa remained strong in the US market. However, raw material supplies are currently tight and are expected to remain so until June. With the rainy season, there may be a supply peak in the short term, temporarily relieving price pressure, but in the autumn, basa prices may rise again.

Despite rising costs, the current U.S. market pricing of basa fish has not been affected, but price movements in the coming months will still depend on U.S. stock depletion.

The channel catfish market is stable and there is no significant change in short-term prices

In March, the price of fork tail catfish in the US market was relatively stable. Demand picked up during Lent, providing some support for prices. However, replacement costs and seasonal production adjustments may bring slight fluctuations after holidays, but industry insiders do not think there is any possibility of a sharp rise in the short term.

Market Outlook: Supply Chain Games under High Tariffs

In the face of rising tariffs, supply chain adjustments and market wait-and-see sentiment, the future of tilapia in the US market remains uncertain. In the short term, inventory factors support price stability, but in the long term, U.S. buyers may accelerate supply chain adjustments, and Central and South American chilled tilapia may become a more important alternative.

Meanwhile, China exporters are turning to new markets, while U.S. importers are looking for more cost-effective options. This market game of supply, demand and policy shifts will continue to evolve. In the coming months, the market may usher in a new adjustment window, let us wait and see.

-

Ecuadorian Shrimp-It's Not Easy To Love You

2024-07-04 -

The AI Lecture of Zhanjiang Chamber of Commerce was successfully held in Quanlian Centralized Procurement, helping the enterprise to upgrade its digital intelligence

2025-04-18 -

Tilapia Tariff Raised to 45%, U.S. Market Waiting for Change

2025-04-02 -

Into the Northwest Frozen Food Hub| All-Union Centralized Procurement Visits Lanzhou Jiaojiawan Frozen Market

2025-03-07 -

China's Ministry of Commerce's latest response to the US imposition of a 10% tariff on Chinese exports to the United States

2025-03-04 -

Ecuador shrimp industry new era, 2024 top ten shrimp enterprises list announced

2025-02-26